In a perfect world we would have smart loans which would for themselves! We are not there quite yet, and so it still falls to you, the consumer, to decide what financial choices are best for you and your future.

In a perfect world we would have smart loans which would for themselves! We are not there quite yet, and so it still falls to you, the consumer, to decide what financial choices are best for you and your future.

This may sound a bit silly, but there is a core principle to finance that many people do not grasp:

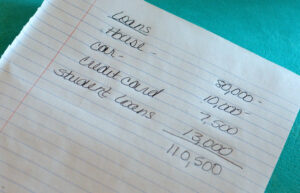

You’ve got to know what you owe.

Understanding Your Debt

Hiding your head in the sand means you purposefully ignore an unpleasant reality. Millions of people do this every single day by looking away from the details of their debt. It’s less painful to not think about it, right?

But the problem continues to grow and get worse the longer you ignore it. Bite the bullet and take a long hard look at your finances. Account for every single penny you owe. Only then can you make an informed, smart loans decision about how to move forward.

There are always lenders who are looking to help people consolidate their loans, and government programs to help people out. You cannot take advantage of any of these options without knowing what you owe, to who, and when every note is due.

Smart Loans are in the Details

The devil is in the details, and many lenders expect you to stick your head in the sand and skip over the small print. Do NOT do this. Once you sign a loan contract you are locked in, having agreed to all the terms presented.

Read and understand all the different aspects of the loan agreement first. You might be inadvertently agreeing to balloon payments or excess fees. Smart loans mean smart loan management, so put in the work, and do the reading.

Remember, always ask questions if you are ever confused about ANYTHING.